Airlines In The Philippines II

1 ...

77787980818283

... 99

1 ...

77787980818283

... 99

Yeah this is the densification project, which started with removing the BCL seats in the A320s before they were transferred to 2P. A few A330 tri-class frames will be reconfigured to higher density, with the removal of the PECY seats (last I heard) and the ECY converted to 9 abreast and deactivating the personal screens in the ECY entire section, and pushing for wireless IFE. This confusing hybrid was the plan from last year though. This should have also included the A350s but I think the plans for the changes in the A350 have been put on hold. |

|

Administrator

|

We discussed this densification last year. As I understand, they will have these planes for six more years. By that basic calculations, we should have its replacement come 2028. Basically right after the 35k deliveries.

Making Sense

|

|

There are rumors that 5J is about to order 737 Max 8 and 10s.

|

|

And that they’re also applying for CAE certification for their training facility in CRK.

|

|

This post was updated on .

In reply to this post by crash&burn

Boeing invited the ff. Cebu Pacific execs to their experience center in Seattle: Mike Szucs, Alexander Lao, Mark Cezar, Candice Iyog, Lei Apostol and Brian Franke |

|

In reply to this post by crash&burn

Thats strange. Why will they order 737 MAX when they still have more NEOs coming in?

|

It didnt say they will order. Its just invitation for marketing and promotion of the Max. I remeber before in the late 80s, my dad had a 15 page brochure of MD-11 for Royal Brunei. They were doing marketing and promotion of the aircraft to Royal Brunei |

|

In reply to this post by Evodesire

Deliveries of A320neo family is slow now

To add P&W engine issue is also hindering the ontime delivery of the jets and maintenance time is longer That's why Boeing is pitching 737max for Cebu Pacific, as usual 5J will not get it unless it will be delivered early and cheap like the time when they got A339 NTUs of AirAsia X Boeing offered 777s and 787 to Cebu Pacific before but they said no, but now lets see |

|

Company insiders said, however, that recent frustrations with Airbus and engine manufacturer Pratt & Whitney — which the airline blamed for flight cancellations and aircraft groundings as a result of these firms’ supply chain issues — made it rethink this strategy. At a certain point, the cost of being tied to single manufacturers starts to outweigh the savings, one executive explained. https://business.inquirer.net/418207/cebu-pacific-in-talks-with-boeing-for-737-fleet |

|

In reply to this post by AnonBoy

SU planning to fly to Manila as it reapplies for a different time pairings.

http://philippineairspace.blogspot.com/2023/08/aeroflot-to-fly-manila-next-year.html?m=1 |

|

Time for Boeing to reestablish itself in the Philippines. Potentially, 737 MAX from Cebu Pacific and 787 from PAL. Interesting!

|

|

Administrator

|

In reply to this post by JNC03

I was told the same story actually last June pa during their senate hearing, but company officials kept under wraps their frustration with Airbus, particularly its engine manufacturer P&W for its neo jets. Unfortunately for CEB, the airline does not own their fleet as they are merely leasing it. For six years, with renewal options. But its major shareholder Indigo Partners does, and made a rethinking about its 255 Airbus orders made in November 2021 at the Dubai Airshow, as these orders were not cast in stones just yet. I would think these prompted them to visit Seattle. While Airbus neos are better planes at this time, its economics is going to be tested with new corrective maintenance schedules imposed by P&W. And that requires force grounding of their fleet for inspection, which hay-wired airline schedules beginning last year. A grounded plane does not earned airline money, https://apnews.com/article/rtx-raytheon-airbus-pratt-whitney-engines-6415eae07f91589050d807f7b3cb9533 CEB had their Neo since 2019. And 6 of the 10 operating 320neos are affected, together with all of its 21n fleet. They are worst affected airline in the Philippines. With that in mind, Boeing order is possible. We could be seeing them in three years time.

Making Sense

|

|

Administrator

|

In reply to this post by Arianespace

PAL Holdings announced the re-appointment of ex-Delta Air Lines executive, Eric David Anderson as new Chief Commercial Officer. This time, Anderson will oversee sales, marketing, revenue management and cargo services.

Anderson previously served as PAL’s vice president for revenue management and strategy under Gilbert Sta. Maria in 2019. I guess this guy really knows what he is doing after getting the ire of the first generation directors regarding pay. You don't usually get a comeback at PAL if you are not that good. By the way, he is not sorry for the broken seats that made money for PAL.

Making Sense

|

|

In reply to this post by Arianespace

Operating two aircraft types especially in narrowbody segment is good, aside from preventing the effects of the issues a certain aircraft faces. It can attract other pinoy pilots working abroad that is type rated to Boeing 737 to work here.

Buying neos with CFM engines might be an option but it has some disadvantages compared to P&W thats why 5J and PAL ordered P&W engines. A320 family production is also in a long line now due to a lot of order from diff carriers. While 737max have a lot of frames lying around waiting for customers. After all 5J wants rapid expansion not just in Manila but to Clark, Davao and Cebu as well and the key to that is an aircraft that is not sensitive to maintenance checks and can be operated for a long time before being grounded for maintenance. |

|

Looks like 5J learned from India's Go First where all their neos were grounded resulting in the bankruptcy of the airline

I wonder aside from holding ceos in their fleet, what will PAL actually do when time cones they need to let go those planes. |

|

Administrator

|

According to one senior executive at 5J attending the senate hearing, Indigo's problem really bothered them, particularly the time when it hit them three months later on the P&Ws geared turbofan engines. They happen to be the largest PW1000G operator in the country, majority of which came prior to the second half of 2021.

This is one circumstance where early technology adopters suffers fate of using new technology with promises of better efficiencies. Because by now, clearly they are not. If you noticed, PAL doesn't always order new aircraft models still to be launch? Now, I know the reasons why.

Making Sense

|

|

This post was updated on .

Buying anything that is tested with time should be the case now

That's why PAL didn't pick the 77X, will this change the course for their A320 replacement? since CEB did what others think impossible which is talking to Boeing and having an interest with the max. As per some ppl PAL is studying to do a engine swap with their NEOs to CFM like IndiGo did |

|

With all the problems P&W is facing now, I think its a blessing in disguise that PAL was able to defer the deliver of their remaining 13 neos. I think its too late to switch engines. Unless they order A320neos where they can go for the LEAP 1A. CFM is known for their reliability. The CFM56 proved it.

I dont know the extent of P&W's liability not only to airlines, but to Airbus themselves. |

|

Administrator

|

Airbus was indeed liable for this fiasco as they marketed P1000g engines for the NEO programs which turned out to be US$8 million more expensive than CEO for 15% efficiency gain. CFM Leap X managed to generate only 14% prompting most airlines to take the former. Few took the latter. Turns out Leap was the better engine. In 2019 CFM got 65% market share for the NEO. I remember Leahy saying in 2010 P&W has 20% lower maintenance costs compared to the CEO. Twelve years later, it turned out not to be the case, with the earlier built P1000g needing more frequent down time. The efficiency gain negated, and the premium priced paid by airlines for the hype losses. If I am Lance I would be fuming mad for breaches of warranty. That is what it is. Unfortunately, for aircraft leases, CEB doesn't have much of a choice. Good thing for them some of their leases ends beginning 2025. Few however notices Boeing 737 MAX beating the A320neo with a higher max payload, 20.8t vs 20t (46,040 lb vs 44,100 lb) and a higher thrust power. The 737 MAX 9 has a super-dense 220-seater variant while the MAX 8 has 200 seats as compared to Airbus 180 seats. Even the super-dense 186 seater bus couldn't beat max. In short, it now can carry more passengers and cargo than Airbus does. The only drawback it had is its more expensive price tag at $122m for the MAX 8 as compared to $112m for the 320neo. For the extra 20 seats, that is $10,000 more per day priced at $100 (P5,500) seats, or about $3.6m for a year of conservative operations (5 single trips/day) at 360 days per year. A measly 2 rotations and half per day. CEB operates 4-5 rotations per day with their neo. The only question now I think is would the price difference be compensable with the gains in both passenger and cargo capacity? Boeing said, by CEB operations and variables they would in 18-24 months. Which is close to the calculations made above. If CEB calculations jibe with that of Boeing we should see them migrate to MAX 8/9 to replace the 320 by 2025. I seriously doubt however their migration to the 10, as the 21n is better.

Making Sense

|

|

In reply to this post by JNC03

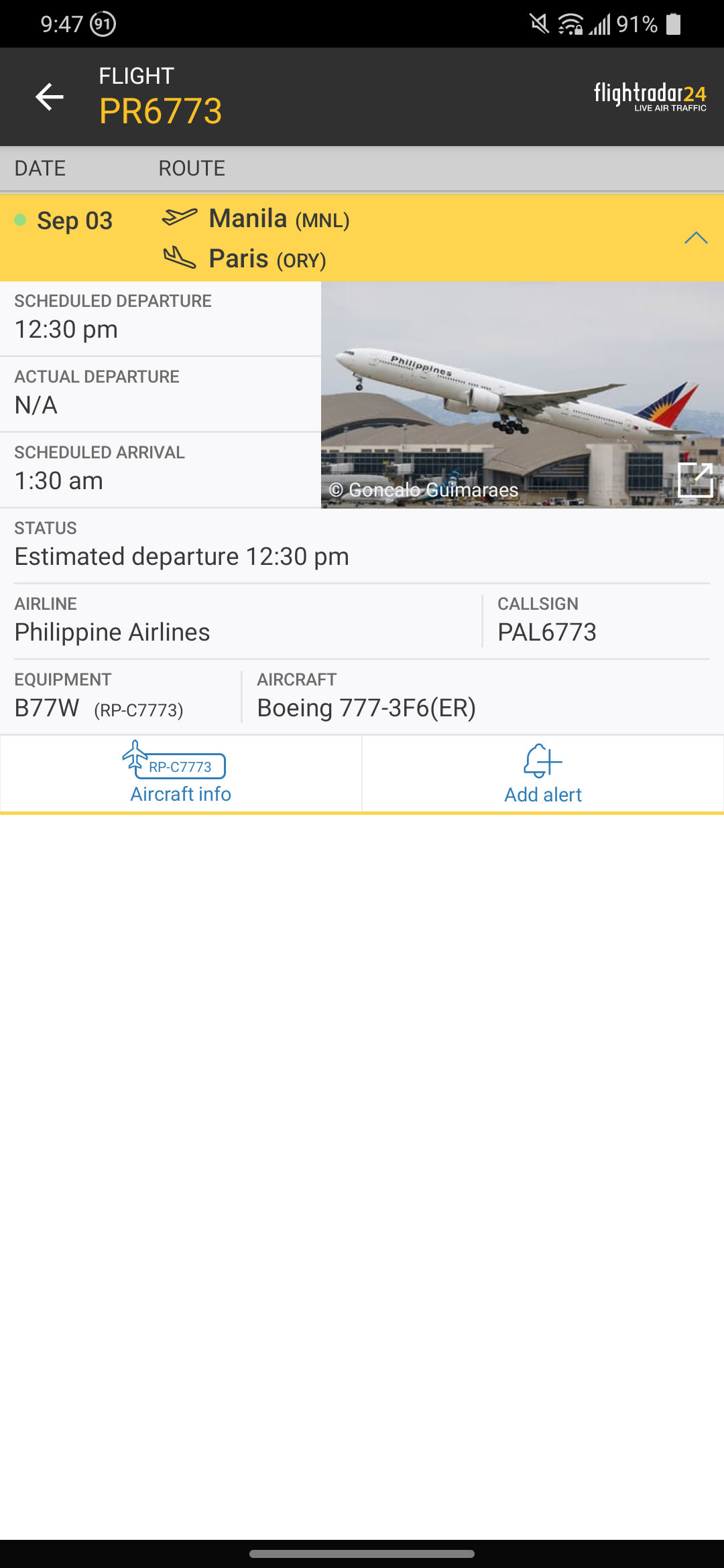

PAL 77W going to Paris |

«

Return to Philippine Aviation Forum

|

1 view|%1 views

| Free forum by Nabble | Edit this page |