Airlines in the Philippines

1 ...

949596979899100

1 ...

949596979899100

|

Star Alliance ❤❤❤

|

|

Okay. ANA gets 10 percent. And... now what? Star alliance membership isn’t a given. A 10 percent stake doesn’t raise all that much cash for new plane orders, nor does it give much influence over management. Beyond the current JV, what’s gonna happen? |

JJB has said that they might try and take advantage of their new partner's favourable purchasing terms if the oppurtunity arises and go into joint purchasing agreements if/when they buy more long-haul aircraft (note that I didn't mention NH here, as he said this a few days before the deal was confirmed). I'm also assuming that the deal involes NH training PR staff in areas such as customer service (which still remains a hit-or-miss experience at best) and the like. |

|

Administrator

|

In reply to this post by Solblanc

Well, new planes are always paid by bank or lessors, not by airline. And from what I'm told $90 million can always finance 8-9 new A350 or 6-7 77W frames. Not much but it just made the airline more liquid. A 0.44% debt ratio is very good according to airline standards. With the money it can go down as low as .40% which is even better. And that is on the financial side. Few however notice that Japan is the other goldmine PAL had outside of North America.

Making Sense

|

|

Does this mean PAL will be exercising the remaining 6 options on the A350? Or perhaps A350-1000? Any chances PAL will obtain the 787s as it can carry more passengers?

|

|

A35K is probable. But the 787 might be a long shot. AFAIK, the 787s are smaller than the 350s. Here in ascending order from smallest to biggest

787-8 / 787-9 / A350-900 / 787-10 / A350-1000 |

|

Well, if they do buy 787s they could always use them to expand to European cities where the demand isn't high enough to warrant an A359 but is still there. They could also use them for long-haul flights out of CEB (namely, CEB-LAX once they restart it) during lean periods.

It's a pretty big IF though. |

|

Administrator

|

In reply to this post by arema

We would know the decision in May. B787 though is not gonna happen. And as was posted earlier by a member, it appears that A359 is too small for the east coast and B77W would appear to be too big. Having said that, I did mentioned before that PAL is following CPA footstep on their fleet plans and they have the 35k. Lets see if that still holds true.

Meanwhile, CAPA and others has been stating based on ANA investment that PAL value is approximately US$1 Billion. That information is wrong. When Lucio Tan Group bought back 49% of Trustmark sold to San Miguel Corporation the transaction was valued already at US$1 Billion and that was in 2014. After that four new B77W and four A359 together with four A321N and nine DH4 joined the fleet adding value to the airline by another $1b. approx. Trustmark as a whole owns 84% of PAL. What ANA bought is 10% of Trustmark. There is more to the deal than the $95 million cash, otherwise that would translate to about 3-4% investment only. Since it is still going to be signed next week the rest of the deal is redacted.

Making Sense

|

|

According to flightglobal 5J has sent an RFI for a possible new wide-body aircraft late-2018. With delivery to start either late-2020 or 2021.

https://www.flightglobal.com/news/articles/cebu-pacific-to-double-widebody-fleet-issues-rfi-455422/ Additionally 5J is looking to double its wide-body fleet to 16 which currently consist of 8 Airbus A330-300. Possible candidates are the Airbus A330neo or Boeing 787 Dreamliner, with the goal to operate high-density truck routes like CEB and DVO for domestic and HKG, ICN, SIN, for international with the possibility to fly the west coast of the US. |

Re: CEB Request for Information (RFI) for New Wide-body Aircraft

|

Administrator

|

The CEA failed to mention that lessees to the first A330 set expires in 2019 and another set expiring on 2020. I've also heard stories that their current A330s is having weight problems in DXB and SYD considering the dense configuration they have. Some baggages have to arrive the next day. Question would be which one is better suited to reach this points at full payload with 436 passengers. According to Airbus data it should do well for 4000nm at full payload around 50t. But that is not what is happening in reality. Would the neo fare better at the same configuration?

Making Sense

|

|

Administrator

|

In reply to this post by Arianespace

Also today, 7776 is in Xiamen for retrofit and check. We should see them with refreshed cabin when they return.

Making Sense

|

|

This post was updated on .

Are they going to use Vantage XL for their 777s or will they use a new product? How long will the retrofit last? And why has PR not announced anything about a new cabin for the 77W yet? One would've guessed that they would at least try to drum up some publicity about it. And speaking of which, will they use some of their new cash to retrofit at least some of the 77Ws and A330s? |

Re: CEB Request for Information (RFI) for New Wide-body Aircraft

|

In reply to this post by Arianespace

Surprised about this one. But they have two A330s that are more capable than the first six that they have. 3347 and 3348 are 242T birds.

|

|

Administrator

|

In reply to this post by idp5601

Are they going to use Vantage XL for their 777s or will they use a new product? How long will the retrofit last? And why has PR not announced anything about a new cabin for the 77W yet? One would've guessed that they would at least try to drum up some publicity about it. And speaking of which, will they use some of their new cash to retrofit at least some of the 77Ws and A330s? Did not state what cabin it would be. I guess it would just be an update to make it consistent with the newer product.

Making Sense

|

Re: CEB Request for Information (RFI) for New Wide-body Aircraft

|

Administrator

|

In reply to this post by peterpiloto

No wonder they are doing DXB and SYD/MEL rounds. I don't have information as to the particular aircraft responsible for offloading. I however would think that even the new one was not enough considering MNL traffic. On some bad days they have to hold for an hour that sometimes they rather settle landing at Clark 40 minutes after contacting MNL approach when they are not called for que within the next 30 minutes. Thats how dire its tanks are or possibly its already reaching the threshold of the safety margin for diversion. Would the NEO give them 2 hours of holding time?

Making Sense

|

|

Administrator

|

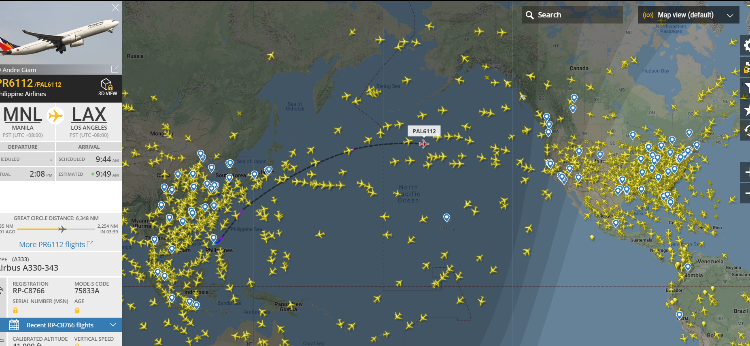

This happens when not a spare 77w can do reliever flight for 7772. This is also an affirmation that A330-300 can reach LAX without issue. Likely it should do tech stop in Japan on its return flight to MNL.

Making Sense

|

Wonder how much pax they carried for this flight. Before the 242T A333s were in service, Aeroflot used to deploy their 235T birds to LAX. |

|

Administrator

|

Fully booked flight. This plane is heavy. Just made tech stop in HNL as usual.

Making Sense

|

|

In reply to this post by Arianespace

I think the A330 flight from MNL to LAX was a utility flight.

|

Re: CEB Request for Information (RFI) for New Wide-body Aircraft

|

In reply to this post by B77Wflyer

Yes, an RFI was sent to Boeing by Ceboac for their 787s. Not sure which variant though

|

«

Return to Philippine Aviation Forum

|

1 view|%1 views

| Free forum by Nabble | Edit this page |